Investing in P2P is really easy. The success and returns that you will get depend on your personal strategy. As an investor in iuvo, you know that the platform enables you to invest in primary and secondary markets.

In brief, the primary market is the place where all available loans in which you can invest are offered. The secondary market enables you to sell already purchased investments. It is most often used when an investor needs to release the amount they have invested without having to wait for their full payback.

The secondary market is a challenging place for many investors. You often ask us questions about the market and how it is functioning. This inspired us to put together the most frequently asked questions that will help you buy or sell loans in the secondary market more efficiently.

1. What is a secondary market?

The secondary market is a place where investors with an active portfolio on the platform can trade with each other. Investors can buy and/or sell loans. Investors acting as sellers of loans usually want to get their investment back and have the right to determine the price at which to sell their loans. It may be lower than the nominal value (with discount), higher than the nominal value (with premium) or equal to it.

2. What is a discount and a premium?

The seller of loans has the opportunity to state a price different from the nominal value. They decide for themselves whether to sell their loans with a discount, at a premium (with mark-up) or at a nominal value. When a loan is offered with a discount, its buyer makes an instant profit because they pay less than they receive. However, when a loan is sold at a premium, then its buyer pays more.

3. What information do the different colors represent?

Loans are marked in different colors. Green means that the loan is available for sale with a discount and red – at a premium (with mark-up).

4. How to choose loans at a discount?

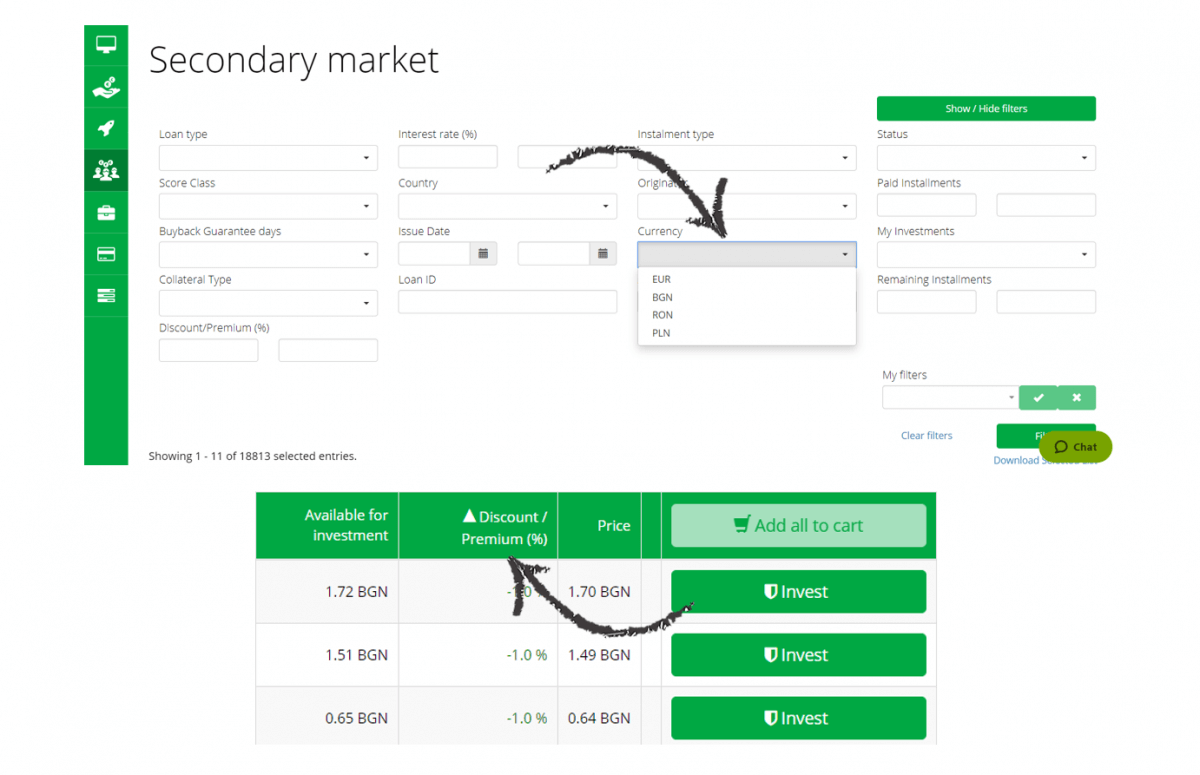

You can view the loans at a discount by selecting from the filter the currency in which you want to invest, and then sorting the entire column. This is how you will first see at the top the loans offered at a price lower than the nominal one.

5. Should I first start investing in the secondary market?

Our recommendation is to become familiar with the primary market and its specifics at first, before proceeding to the secondary market.

6. What are the benefits of the secondary market?

In the secondary market, buyers have access to loans that are no longer available in the primary market and sellers are able to get back their investment faster.

7. How to avoid a loss in a secondary market?

Most often, secondary market losses are generated by loans offered at a premium. To avoid them, always use filters by selecting a discount/ premium option equal to not more than 0. Thus, you will only see the loans at a discount and those at a nominal value (0%).

8. How can I make a profit in a secondary market?

You have two options for making a profit in a secondary market. The first is to offer for sale your loans at a price higher than their nominal value. The other option is to buy loans available for sale at a discount.

9. Is there a fee for selling loans in the secondary market?

When making a transaction in the secondary market, the seller shall pay a fee of 1% of the value of the sale. The fee shall be charged only if a sale transaction is made. If you offer loans for sale, but they are not bought, no fee shall apply.

10. How to participate in the secondary market?

As a buyer you have constant access to the secondary market. The filters that we recommend you to use are identical to those of the primary market. You can buy a loan by adding and confirming the loans in the cart.

If you want to sell loans in the secondary market, you can do so on My Investments section.

11. I want to get back my investments quickly, at what percent should I offer my loans for sale in the secondary market?

The easiest way to get out of an investment quickly is to offer your loans for sale at a discount in the secondary market. The decision as to what the sale discount should be depends on the current availability of loans in the market, and on how long you will need the funds. If no loans at a discount are currently available, – then 0.5% would be sufficient.

12. Can I use the auto-invest option in the secondary market as well?

Currently, the auto-invest option applies only to a primary market. To sell loans in the secondary market, you need to do it manually and after confirming the selection in your investor cart.

en

en