Official statements by the CEOs of iCredit Poland, iCredit Romania, and Viva Credit.

We started a series of articles with statements from the CEOs of our holding and the credit companies we work with. In the previous post, we shared the statements of MFG, Easy Credit, and Access Finance regarding the stability of the companies at the moment.

Now we publish the statements of the CEOs of iCredit Poland, iCredit Romania, and Viva Credit. Read them below:

iCredit Poland

“The current political situation and the military conflict do not have any negative impact on the sales and collection KPIs”

Konstantin Stoychev, CEO, iCredit Poland

Originator on iuvo since 2020

Poland as country is unarguably the most engaged and supporting country into the Russian-Ukrainian conflict, aside from Ukraine and Russia. Probably over 70% of all the refugees that left Ukraine so far have crossed the UA/PL border. The expectations that their number will soon reach 2 million to be accommodated in Poland. Even so we don’t see any threat so far for the lending business of iCredit Poland data as for 20.03.2022.

Also, it is highly possible that in global aspect we may expect an even higher inflation and many customers might experience difficulties in terms of repayments.

However, iCredit Poland has significantly changed the customer profile several months ago and every potential client is a subject of even more detailed check in several companies specialized in credit risk check. Moreover, we have implemented two separate and independent scorings for better evaluation. Therefore, we don’t expect any deterioration in the collection. Additionally, the banks are significantly increasing their prices, which means it is highly likely many people will need additional funds and microcredits to fill the gaps in their budgets due to the significantly increased installments on their bank credits.

This led us to develop a new premium product, which is slightly cheaper, to target a higher customer profile and we are about to launch pretty soon a new VIP product with more favorable conditions and prices for the customers and innovative parameters.

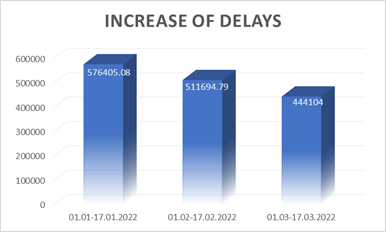

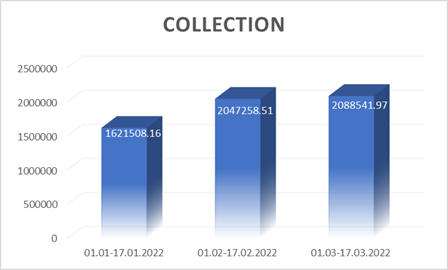

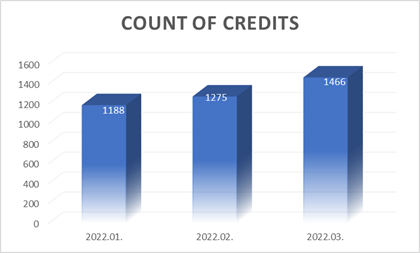

The current political situation and the military conflict does not have any negative impact on the sales and collection KPIs. In February compared to January, we had better sales with 7% and 20% lower increase of delays – these 2 KPIs are making a very good scissor. We keep collection on similar level. According to our prognoses, current conflict will not affect the results in March or the following months. We expect 15% better results in main business parameters: sales and collection. The company has a stable and growing trend in terms of sales, collection and improvement as seen on the graphs below.

(the lower, the better)

(the higher, the better)

(the higher, the better)

Viva Credit

“We keep growing and progressing”

Svilen Petkov, CEO, Viva Credit

Originator on iuvo since March 2017

In the beginning of the pandemic, we took actions to better our scoring models and the evaluation of the borrowers. As a result, we do not account any direct effect on the sales and collection, quite the opposite – we have an increase in the company’s profit compared to last year.

In the end of 2020 and the beginning of 2021, we opened 17 new offices, which increased the growth of our active clients with over 35%. Since then, 10 new offices have been opened and we expect to keep this trend for increasing the active clients.

In regards to the new circumstances, which we are facing in the beginning of 2022, and the constantly growing prices of goods and services, we expect an increased demand of cash and for the borrowers to experience difficulties when it comes to repayment of loans. For the purpose, we took additional actions for improving the approval criteria and the scoring models, we limited the highest risk clients and the amounts we lend to new borrowers. Based on the actions taken, we expect to keep the growth in sales, collection, and profit of the company in 2022.

The military conflict will definitely have economic consequences but it does not have an effect on our business and we continue growing and progress.

iCredit Romania

“Our business is not affected by the conflict, we accounted growth in both the quantity and quality indicators”

Alben Mitarev, CEO, iCredit Romania

Originator on iuvo since 2017

At the moment, there is no direct negative effect, even the loan demand and collection have increased. On the other hand, we expect that the constantly growing prices of goods and raw materials in combination with inflation will affect the solvency of the borrowers in the long term and that they will have difficulties with repaying the loans.

This is why we have taken precautionary measures regarding collection by smoothly decreasing the installments and increasing the period of repayment, so the borrower can remain a good payer. In addition to the collection, by improving the approval criteria and the scoring system, the selection of borrowers is refined. We also created a new promo product with less increase in price, which is already on the market.

In the past 4 months, the company increased its collection up to 98% and accounted sales growth. The interest revenue has a growing trend, as well as the profit. Delays on loans are limited to about 20% regarding the principal, and the share of borrowers with credit indebtedness below 40% is also increasing compared to the exceptions for medical and educational purposes.

As of today, we can bravely confirm that our business in Romania is not affected by the conflict, we even account growth in both the quantity and quality indicators.

en

en