The world is still going through the challenges of the global pandemic and economy downturn, that are affecting borrowers all around the globe. Since the mid of March, plenty of European countries declared a state of emergency. Big part of the business and the people working there started having difficulties to pay their debts. The situation is aggravated by the threat of mass cutbacks.

Governments and different European institutions are debating and taking measures to relief the situation. The governments are striving to help those businesses and employees, that have been affected the most. One of the ways is with legal regulations and stimulation of the financial institutions to reconsider the existing maturity of loan payments. Several countries are considering it.

Our industry is also feeling the effects of the force majeure situation. This imposes certain measures to be taken, that would not have been necessary under normal conditions. Regardless of the changes, iuvo’s focus remains the same – our mission is to provide you with a first-class service and a good yield, combined with the safety of our originators.

We know that times are challenging but we are sure that we can go through all of this together, and then come out stronger. We stand responsible to our originators as well, and we believe that the right thing to do is to have a reasonable attitude towards the economy and society.

We have already proven to you that caring for iuvo’s investors is as important as having good partnership practices. Collaboration is in the base of maintaining the financial health and stability of our originators in these force majeure circumstances. We believe that with joint efforts and mutual focus we can overcome this challenge together.

In order to be in sync with the changes that are affecting the business of the credit companies, we are introducing a new functionality in our platform. We would give a possibility for maturity term extension of the loans, and securing a grace period on their principle. We will be informing you about every maturity extension in the payment schedule of a loan, granted by any of our originators.

What will be changed?

– The originators will be given the possibility to change the payment schedule of a loan by extending the maturity, according to the renegotiation.

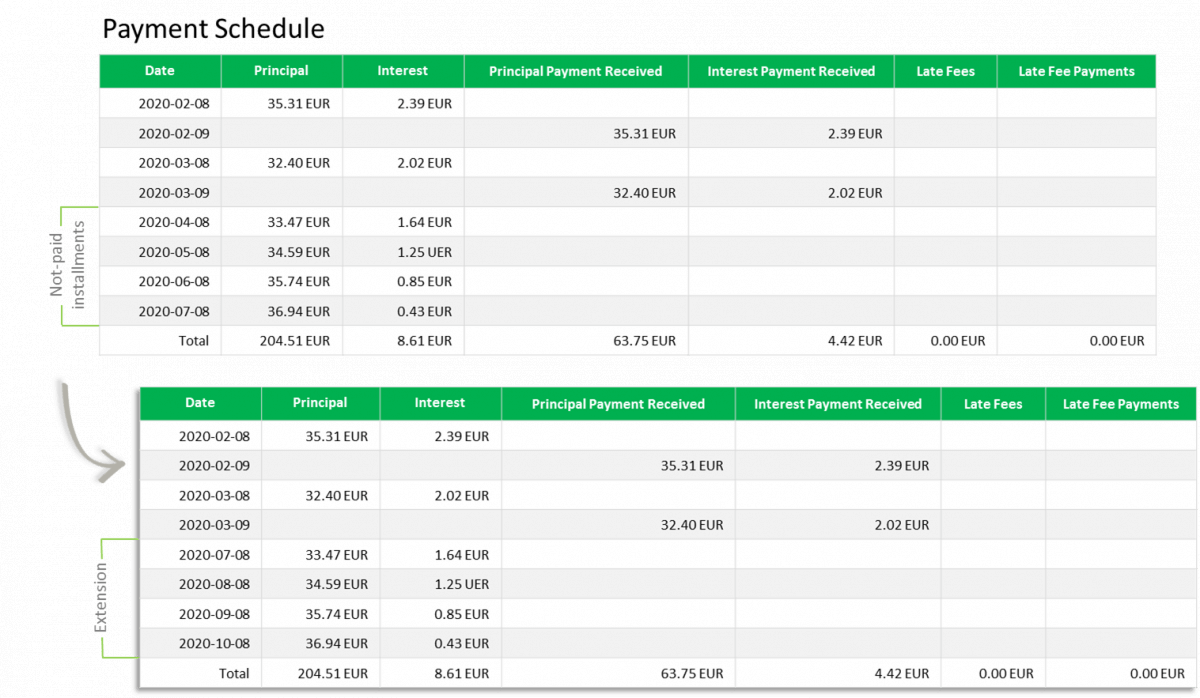

– The change will affect the dates of the expected payments of installments and the end date of a loan. There will be no change in the number of installments or their amount. There is an example – the installments remain the same, the only change we see is in the dates:

During the negotiated term extension, the originators will be paying interest to the investors in the form of “late fee payments” on every 25th of the month. This way the originator will compensate you entirely at their expense for the extended period, in which your funds will be invested in their loans. The moratoriums in the countries do not suggest extra interest payments, that are different than the ones, negotiated in the first place. It is something that is a result of the negotiations between iuvo and the originators.

Important to know:

When calculating loan interest, cash flow in a period of time is what is being taken into account. When the end date is changed (renegotiation), the interest rate also changes because the time period for the payment of the same amount of money is increasing. This is the reason for the change of the visualized interest rate. This change will be compensated with late fee payments on the 25th of each month during the time of the grace period, in case such has been negotiated with the originator.

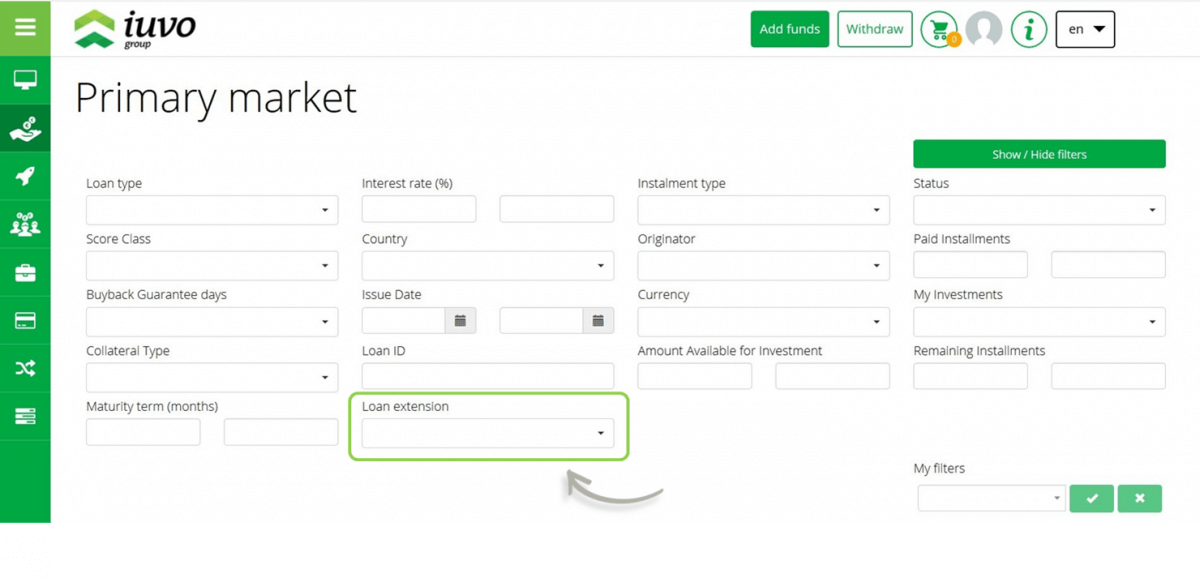

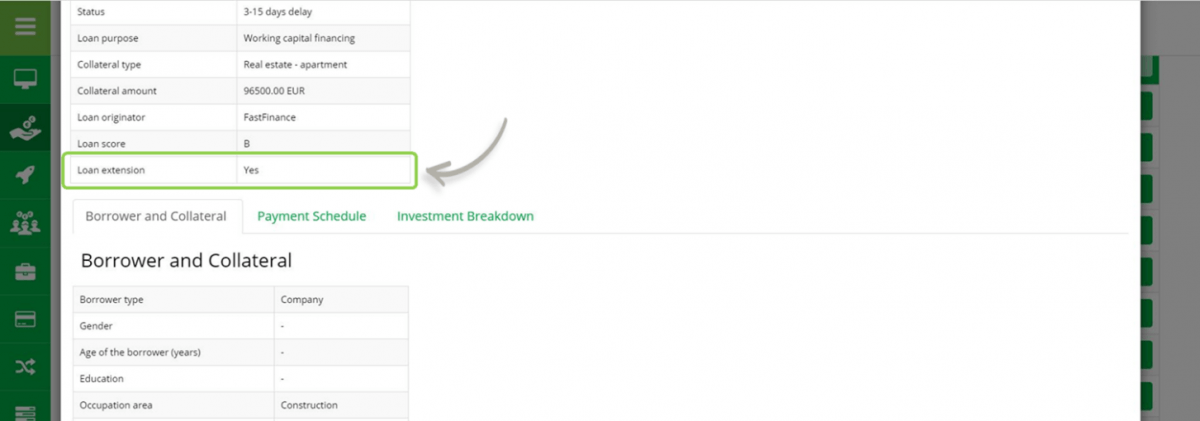

– Adding a new functionality on the platform – “Loan extension” filter and information in “Loan details”. Every loan that has a changed and extended payment schedule will be marked as such.

The circumstances we work in are dynamic and we take the responsibility to share every upcoming change that affects you and your funds. You can reach our team by chat, phone, and email – we will be happy to answer your questions. Our hard word continues as well as the constant communication with our partners, in order to ensure that you are going to be satisfied with lucrative investments.

en

en