Is it possible to work for your money for the first half of your life and your money to work for you for the second half?

Sound financial literacy is crucial, not only for balanced finances in the present but for future stability that carries peace and perspectives with it.

It starts with learning basic concepts and rules which you can build upon on your way to the right money management and the big goal – financial independence.

Save money regularly

It seems obvious, but many do not follow that rule. You undoubtedly know people who manage to waste all they earn. However, if you’d like to invest and generate a return, you must learn to save money.

The instability of financial markets and economic turbulence that we witnessed in the past few decades made lots of people stop trusting the financial system and investments in particular.

Despite that, the truth is simple: if you want your money to work for you, firstly you have to have money. If you want to have money, saving must become a habit or a philosophy regardless of your earnings amount.

Make your money work for you

The intuitive decision on what to do with your savings is simple: save them in a bank account. The rational decision, however, is completely different. The annual profit that can be generated with these deposits is meager – about 1% (in some cases the banks offer even negative interest rates). The deflation observed in Bulgaria and Europe for the past years indicates there’s a possibility for interest rates to drop even more.

Then how can money work for you while remaining deposited in bank accounts? The answer is simple – they don’t.

For your money to work for you, you must generate return or if we have to word it differently – you must not just save them but also invest them.

Investments are not territory reserved for a few chosen ones, financial experts or gurus. Making investments is for anyone who is willing to improve their financial culture and ready to use the benefits it can bring.

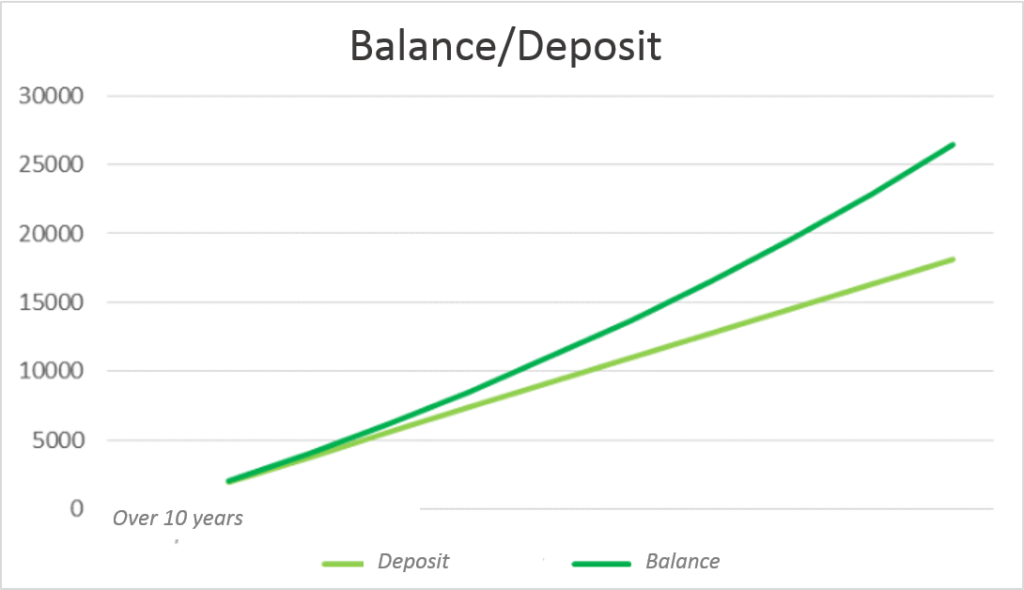

This is how your balance would look if you saved and invested 150 Bulgarian Levs each month with 7% annual return for 10 years:

Plan your future

Think of your investments as a long path that you need to walk, however; you need to make the first step. Do not forget where you are going and what your final goal is: financial stability and independence. Often remind yourself this when you lose motivation, or your discipline weakens.

This exemplary table illustrates the potential that controls money well. If you start with 5 000 EUR and add 5 000 EUR each year, with a stable interest rate, the final results would look something like this:

| Annually invested funds | Annual return | Funds after 10 years | Funds after 20 years | Funds after 40 years |

| 5000 EUR | 4% | 69 832.98 EUR | 165 801.62 EUR | 518 137.78 EUR |

| 5000 EUR | 7% | 83 753.75 EUR | 238 674.31 EUR | 1 142 920.14 EUR |

| 5000 EUR | 10% | 100 624.55 EUR | 348 650.00 EUR | 2660 555.33 EUR |

At first sight, the difference in the annual return seems minor. However, its reflection on long-term results is quite significant. If you start investing at the age of 35 with 5000 EUR yearly investment and a return of 7% annually, when you retire in 30 years (why not even earlier) you could easily have 543 426.48 EUR. Even if you withdraw yearly 4% of them while the rest of them continue generating a return, you would be able to add more than 20 000 EUR to the remainder of your earnings or pension.

If you manage your money correctly in the first half of your life, you can easily double your earnings in the second half of your life. Of course, there’s nothing secure and everything is possible. Investing is not a race, but rather a marathon that brings a reward worth the efforts. Start making your P2P investments with iuvo now!

en

en